Franklin FTSE Brazil UCITS ETF (EUR) | FLXBRegistrati per vedere i rating |

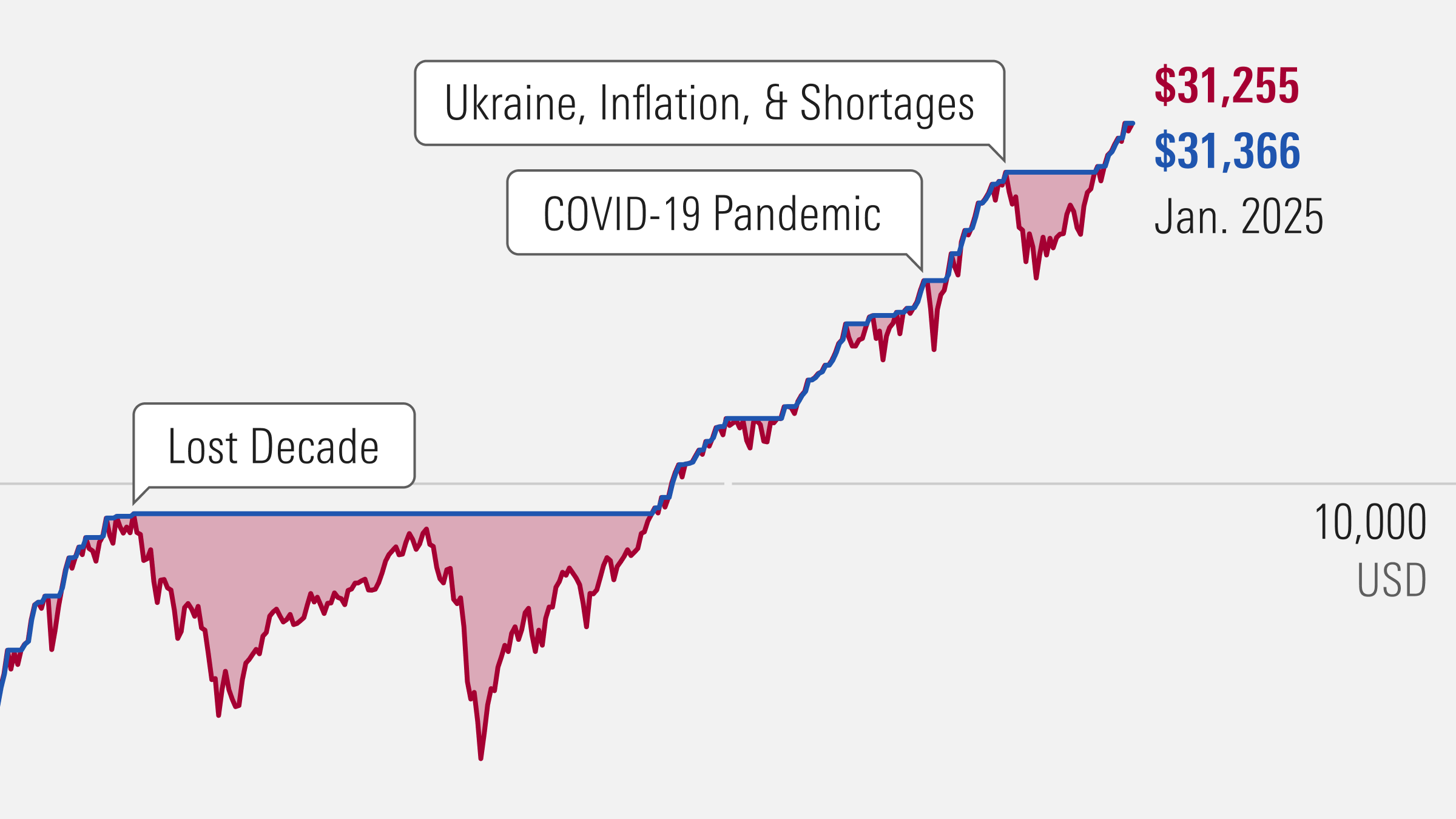

| Storico dei rendimenti | 31/03/2025 |

| Crescita di 1000 (EUR) | Grafico Interattivo |

| Sintesi | ||

| Prezzo di chiusura 04/04/2025 | EUR 20,685 | |

| Var.Ultima Quotazione | -6,06% | |

| Categoria Morningstar™ | Azionari Brasile | |

| Volume | 11444 | |

| Borsa | BORSA ITALIANA S.P.A. | |

| Isin | IE00BHZRQY00 | |

| Fund Size (Mil) 04/04/2025 | USD 36,47 | |

| Share Class Size (Mil) 04/04/2025 | USD 36,47 | |

| Spese correnti 12/02/2025 | 0,19% | |

| Obiettivo d'Investimento Dichiarato: Franklin FTSE Brazil UCITS ETF (EUR) | FLXB |

| The objective of the Sub-Fund is to provide exposure to large and midcapitalisation stocks in Brazil. The investment policy of the Sub-Fund is to track the performance of the Index (or such other index determined by the Directors from time to time as being able to track substantially the same market as the Index and which is considered by the Directors to be an appropriate index for the Sub-Fund to track, in accordance with the Prospectus) as closely as possible, regardless of whether the Index level rises or falls, while seeking to minimise as far as possible the tracking error between the Sub-Fund’s performance and that of the Index. |

| Rendimenti % (EUR) | ||||||||||

|

| Gestione | ||

Nome del Gestore Inizio Gestione | ||

Dina Ting 04/06/2019 | ||

Lorenzo Crosato 04/06/2019 | ||

| Click here to see others | ||

Data di Partenza 04/06/2019 | ||

| Pubblicità |

| Indice | |

| Benchmark Dichiarato | Indice di Categoria Morningstar |

| FTSE Brazil 30/18 Capped NR USD | Morningstar Brazil TME NR USD |

| Target Market | ||||||||||||||||||||

| ||||||||||||||||||||

| Composizione del Fondo Franklin FTSE Brazil UCITS ETF (EUR) | FLXB | 04/04/2025 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| Primi 5 Titoli | Settore | % |

Petroleo Brasileiro SA Petrobras... Petroleo Brasileiro SA Petrobras...

|  Energia Energia | 8,82 |

Vale SA ADR Vale SA ADR |  Materie prime Materie prime | 8,77 |

Itau Unibanco Holding SA ADR Itau Unibanco Holding SA ADR |  Finanza Finanza | 7,68 |

Petroleo Brasileiro SA Petrobras... Petroleo Brasileiro SA Petrobras...

|  Energia Energia | 6,39 |

B3 SA - Brasil Bolsa Balcao B3 SA - Brasil Bolsa Balcao |  Finanza Finanza | 3,30 |

Incremento Incremento  Decremento Decremento  Nuova Posizione Nuova Posizione | ||

| Franklin FTSE Brazil UCITS ETF (EUR) | FLXB | ||